lol.

-

@skinnylatte pretty much. A move out to a cheaper area is a zero-sum to loss unless maybe you're close to retirement.

@StevenSavage @skinnylatte We're in the process of trying to move to a cheaper place where our kids won't have to do active shooter drills at school, where people enjoy universal healthcare, and where there are no masked secret police abducting people and killing people in the streets.

So, y'know, not all moves are created equal.

-

@StevenSavage @skinnylatte We're in the process of trying to move to a cheaper place where our kids won't have to do active shooter drills at school, where people enjoy universal healthcare, and where there are no masked secret police abducting people and killing people in the streets.

So, y'know, not all moves are created equal.

@Legit_Spaghetti @StevenSavage I lived in some of those places first before coming here, and have found the racial aspects more intolerable, and their own fascist moves also terrifying to see, but the gun violence aspect is real. Good luck

-

The main reason people aren’t moving to a cheaper place is

You’ve moved to a cheaper place with your remote job. Cool

Your company reduces your salary 20% because of cost of living adjustments (they will).

Cool, now you live in the sticks, make less money. Maybe somewhere you don’t know anyone. Maybe somewhere you’re a minority.

You get laid off, because layoffs

Now you’re looking for a job in a place that doesn’t have jobs, and you can’t move back to California. With a ton more jobs, but harder to move back into.

That’s the real tradeoff.

But some people think success means owning a huge house in a place they don’t know anyone and have no community.

Always puzzled me as well. Why is owning a house more important compared to having a community you can be around?

-

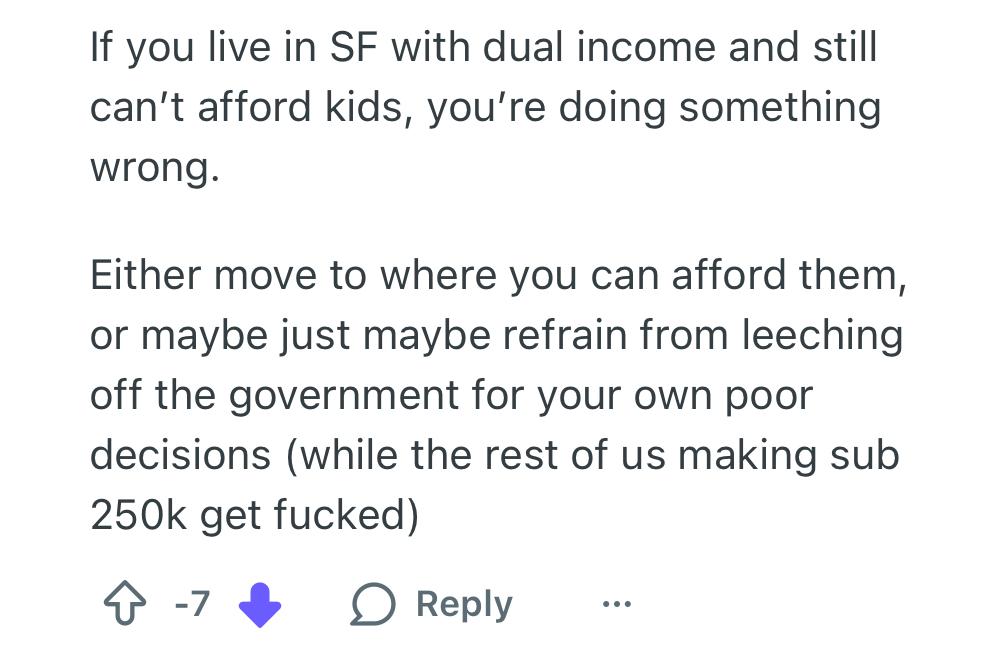

@deirdrebeth they were responding to the childcare subsidy being offered to families making up to 250K and seeing this as a subsidy of rich people.

The solution is obv to make childcare free for everyone, not to get fixated on who gets what benefits

But also

https://www.sfgate.com/local/article/under-100k-low-income-san-francisco-18168899.php

Those people you’ve listed def do not live in the city. They commute hours to get there. They wouldn’t qualify to rent the cheapest apt

Yeah, that was the point I was clearly failing to make. 😀

The people that make that city into the place people want to live, can't even come close to affording it, let alone those who qualify for the subsidy.

I moved away from Palo Alto when my housing options were a 2k studio! It's a different world in the bay.

-

The main reason people aren’t moving to a cheaper place is

You’ve moved to a cheaper place with your remote job. Cool

Your company reduces your salary 20% because of cost of living adjustments (they will).

Cool, now you live in the sticks, make less money. Maybe somewhere you don’t know anyone. Maybe somewhere you’re a minority.

You get laid off, because layoffs

Now you’re looking for a job in a place that doesn’t have jobs, and you can’t move back to California. With a ton more jobs, but harder to move back into.

That’s the real tradeoff.

But some people think success means owning a huge house in a place they don’t know anyone and have no community.

-

The main reason people aren’t moving to a cheaper place is

You’ve moved to a cheaper place with your remote job. Cool

Your company reduces your salary 20% because of cost of living adjustments (they will).

Cool, now you live in the sticks, make less money. Maybe somewhere you don’t know anyone. Maybe somewhere you’re a minority.

You get laid off, because layoffs

Now you’re looking for a job in a place that doesn’t have jobs, and you can’t move back to California. With a ton more jobs, but harder to move back into.

That’s the real tradeoff.

But some people think success means owning a huge house in a place they don’t know anyone and have no community.

@skinnylatte yeah this is the double edged sword, but as a father of a family of three and the sole income earner, not owning a house meant no chance of retiring -- ever -- and working till I die.

At least with a house paid off there's a chance.

As a renter in Vancouver my raises were just barely keeping up with cost of living. I was barely able to save and inflation ensured that rent prevent any chance of me building savings at a fast enough rate for retirement.

Now that the funds from rent are going to equity in a house, there's a chance. Its slim as all hell.. But I'll take the chance over no hope. As a renter the logical end was living in a seniors home eventually, but those cost more than my mortgage per month.

Paying off a property, no matter how crappy, small or rural, means in 25 years you're only paying property tax, which is always much much much cheaper than rent.

With 4% rent increase per year from landlords in most of Canada, even if I somehow magically saved 1.5 _million_ for retirement, I would only be able to pay for my wife and I to retire for 15 years at _current_ cost of living, and that presumes cost of living stays stable, which of course is absolutely not a thing.

-

The main reason people aren’t moving to a cheaper place is

You’ve moved to a cheaper place with your remote job. Cool

Your company reduces your salary 20% because of cost of living adjustments (they will).

Cool, now you live in the sticks, make less money. Maybe somewhere you don’t know anyone. Maybe somewhere you’re a minority.

You get laid off, because layoffs

Now you’re looking for a job in a place that doesn’t have jobs, and you can’t move back to California. With a ton more jobs, but harder to move back into.

That’s the real tradeoff.

But some people think success means owning a huge house in a place they don’t know anyone and have no community.

@skinnylatte min/maxing M/LCOL cities is funny too. Economic data travels at the speed of light and your moving truck most definitely does not.

-

The main reason people aren’t moving to a cheaper place is

You’ve moved to a cheaper place with your remote job. Cool

Your company reduces your salary 20% because of cost of living adjustments (they will).

Cool, now you live in the sticks, make less money. Maybe somewhere you don’t know anyone. Maybe somewhere you’re a minority.

You get laid off, because layoffs

Now you’re looking for a job in a place that doesn’t have jobs, and you can’t move back to California. With a ton more jobs, but harder to move back into.

That’s the real tradeoff.

But some people think success means owning a huge house in a place they don’t know anyone and have no community.

@skinnylatte I just moved back to San Francisco, from a Portland suburb. I'd been intending to move once I found a job in the area, but I became unemployed. My mother-in-law owns the building I'm living in, and I'm not expected to pay rent until I find a job. This is, obviously, enormously fortunate for me.

But most of the jobs I see advertised that I'm qualified for are in the South Bay, and since I can't drive, that means five hours a day of transit, or trying to find another apartment.

-

@skinnylatte I just moved back to San Francisco, from a Portland suburb. I'd been intending to move once I found a job in the area, but I became unemployed. My mother-in-law owns the building I'm living in, and I'm not expected to pay rent until I find a job. This is, obviously, enormously fortunate for me.

But most of the jobs I see advertised that I'm qualified for are in the South Bay, and since I can't drive, that means five hours a day of transit, or trying to find another apartment.

@skinnylatte Also not great that almost all the jobs are either working for Nvidia, or working for a subcontractor for Nvidia, and that's going to blow any day now and take out most of the regional economy with it.

-

lol.

San Francisco is merely speedruning the unaffordability crisis, but moving somewhere else to make less money that is also becoming less affordable and with way less nice things (like high salaries) is also.. not the smart financial move that the ‘just move to a cheap place’ people believe.

@skinnylatte 7 downvotes lol

-

@skinnylatte yeah this is the double edged sword, but as a father of a family of three and the sole income earner, not owning a house meant no chance of retiring -- ever -- and working till I die.

At least with a house paid off there's a chance.

As a renter in Vancouver my raises were just barely keeping up with cost of living. I was barely able to save and inflation ensured that rent prevent any chance of me building savings at a fast enough rate for retirement.

Now that the funds from rent are going to equity in a house, there's a chance. Its slim as all hell.. But I'll take the chance over no hope. As a renter the logical end was living in a seniors home eventually, but those cost more than my mortgage per month.

Paying off a property, no matter how crappy, small or rural, means in 25 years you're only paying property tax, which is always much much much cheaper than rent.

With 4% rent increase per year from landlords in most of Canada, even if I somehow magically saved 1.5 _million_ for retirement, I would only be able to pay for my wife and I to retire for 15 years at _current_ cost of living, and that presumes cost of living stays stable, which of course is absolutely not a thing.

@Routhinator I think that makes lots of sense in some housing markets but not others. Maybe a few years ago with lower interest rates. Today, buying a home anywhere close to any job I could have costs 2x more than renting where I am, and property tax and renovation and house upkeep is also unreasonable. If the market changes again the math might work better

-

@Routhinator I think that makes lots of sense in some housing markets but not others. Maybe a few years ago with lower interest rates. Today, buying a home anywhere close to any job I could have costs 2x more than renting where I am, and property tax and renovation and house upkeep is also unreasonable. If the market changes again the math might work better

@skinnylatte I do have the good fortune of working for a silcon valley company that treats all of Canada as the same payscale, unlike the situation in the US.

There is risk. I was interviewed by Equinix and they wanted to pay me 1/3rd of what I make now for the same role. The salary they claimed I qualified for in Campbell River wouldn't be possible to survive on with today's cost of living and seemed to be aligned to numbers from 2000ish. In 2026, the only difference in cost of living between a major city and a small one in Canada is the rent and value of homes. Food, hydro, all other services are the same. And the rent doesn't scale down much. A 1 bedroom apartment in Campbell River is about 10% cheaper than one in Vancouver, while companies apparently think that means I can live on 60% less.

I just avoid companies with outdated thinking where possible.

The salary Equinix was pitching for someone from Campbell River in my role was less than what my brother makes doing unskilled labor at a local fish plant.

-

2 bedrooms in the city is 4.5k in rent or double that in mortgage. Childcare is 4K. Yeah, take that nice big annual salary, shave off 33% in taxes, deduct rent or mortgage and childcare and see if that works.

(There are cheaper rent controlled 2BR apts. maybe 3.6? But they would be much older)

That’s why people aren’t having kids. At any salary range.

Yeah I get so frustrated when people rant about how mortgages are cheaper than rent

It really depends on where you live

-

undefined oblomov@sociale.network shared this topic on

undefined oblomov@sociale.network shared this topic on